| 26 | Periodic interest rate,rate of return or discount rate (given present value,future value,number of periods) | -596s.png) |

| 27 | Cumulative present value of future cash flows (discount rate,periodic interest rate,rate of return,periodic payment) | -597s.png) |

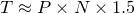

| 28 | Felix`s corollary to the rule of 72 |  |

| 29 | Periodic payment amount(given felix`s corollary to the Rule of 72 and number of payments) | -654s.png) |

| 30 | Number of payments(given felix`s corollary to the rule of 72 and periodic payment amount) | -655s.png) |

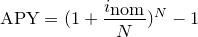

| 31 | Annual percentage yield |  |

| 32 | Nominal interest rate(given annual percentage yield and number of compounding periods per year) | -657s.png) |

| 33 | Perpetuity |  |

| 34 | Amount of the periodic payment(given the present value of the perpetuity and yield) | -659s.png) |

| 35 | Yield(given the present value of the perpetuity and the amount of the periodic payment) | -660s.png) |

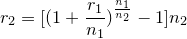

| 36 | Compounding basis |  |

| 37 | Compounding basis(when interest is continuously compounded) | -662s.png) |

| 38 | The stated interest rate with a compounding frequency n(when interest is continuously compounded) | -663s.png) |

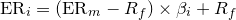

| 39 | Capital asset pricing model |  |

| 40 | Risk-free rate of interest(given the expected return and the sensitivity of the expected excess asset returns) | -665s.png) |

| 41 | Sensitivity of the expected excess asset returns(given the expected return and the risk-free rate of interest) | -666s.png) |

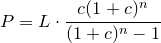

| 42 | Loan payment |  |

| 43 | Loan (given fixed monthly payment,months and monthly interest rate) | -668s.png) |

| 44 | Months(given fixed monthly payment,loan and monthly interest rate) | -669s.png) |

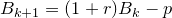

| 45 | Balance of a loan with regular monthly payments |  |

| 46 | Balance of a loan with regular monthly payments(given period payments and period rate) | -671s.png) |

| 47 | Period payments(given balance of the loan and period rate) | -672s.png) |

| 48 | Period rate(given balance of the loan and period payments) | -673s.png) |

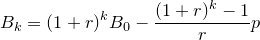

| 49 | Balance of a loan with partial sum of a geometric series |  |

| 50 | Initial balance(given balance after k payments,balance index,period payment and period rate) | -675s.png) |