| 26 | Number of periods,months or year (present value,future value,periodic interest rate or required rate of return) | -595s.png) |

| 27 | Periodic interest rate,rate of return or discount rate (given present value,future value,number of periods) | -596s.png) |

| 28 | Cumulative present value of future cash flows (discount rate,periodic interest rate,rate of return,periodic payment) | -597s.png) |

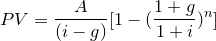

| 29 | Present value of a growing annuity |  |

| 30 | Annuity payment in the first period(given present value,rates,period) | -610s.png) |

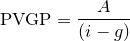

| 31 | Present value of a growing perpetuity |  |

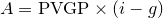

| 32 | Value of the individual payments (given present value of a growing perpetuity,interest rate and fixed rate |  |

| 33 | Interest rate (given present value of a growing perpetuity,value of the individual payments and fixed rate) | -613s.png) |

| 34 | Fixed rate (given present value of a growing perpetuity,value of the individual payments and interest rate) | -614s.png) |

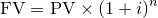

| 35 | Future value of a present sum |  |

| 36 | Present value (given future value of a present sum,interest rate and number of periods) | -616s.png) |

| 37 | Number of periods (given future value of a present sum,interest rate and present value) | -617s.png) |

| 38 | Interest rate (given future value of a present sum, number of periods and present value) | -618s.png) |

| 39 | Future value of a growing annuity(interest rate not equal to growing rate) | -619s.png) |

| 40 | Value of initial payment paid(given future value of a growing annuity,interest rate,growing rate and number of periods) | -620s.png) |

| 41 | Future value of a growing annuity(interest rate equal to growing rate) | -621s.png) |

| 42 | Value of initial payment paid(given future value of a growing annuity,interest rate and number of periods)(interest rate equal to growing rate) | (interest-rate-equal-to-growing-rate)-622s.png) |

| 43 | Present value with continuous compounding |  |

| 44 | Future payment at time t(given present value,rate and time ) | -624s.png) |

| 45 | Continuously compounded rate(given future payment,present value and time ) | -625s.png) |

| 46 | Time(given future payment,present value and continuously compounded rate ) | -626s.png) |

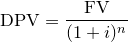

| 47 | Discounted cash flow |  |

| 48 | Nominal value of a cash flow amount (given discounted cash flow,time and rate) | -628s.png) |

| 49 | Time in years before the future cash flow occurs (given discounted cash flow,nominal value of a cash flow amount and rate) | -629s.png) |

| 50 | Interest rate (given discounted cash flow,nominal value of a cash flow amount and time in years before the future cash flow occurs) | -630s.png) |