| 76 | Risk-free rate of interest(given the expected return and the sensitivity of the expected excess asset returns) | -665s.png) |

| 77 | Sensitivity of the expected excess asset returns(given the expected return and the risk-free rate of interest) | -666s.png) |

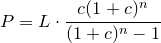

| 78 | Loan payment |  |

| 79 | Loan (given fixed monthly payment,months and monthly interest rate) | -668s.png) |

| 80 | Months(given fixed monthly payment,loan and monthly interest rate) | -669s.png) |

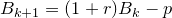

| 81 | Balance of a loan with regular monthly payments |  |

| 82 | Balance of a loan with regular monthly payments(given period payments and period rate) | -671s.png) |

| 83 | Period payments(given balance of the loan and period rate) | -672s.png) |

| 84 | Period rate(given balance of the loan and period payments) | -673s.png) |

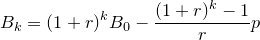

| 85 | Balance of a loan with partial sum of a geometric series |  |

| 86 | Initial balance(given balance after k payments,balance index,period payment and period rate) | -675s.png) |

| 87 | Period payment(given balance after k payments,balance index,initial balance and period rate) | -676s.png) |

| 88 | Loan-to-value ratio |  |

| 89 | Loan amount(given loan-to-value ratio and total appraised value) | -678s.png) |

| 90 | Total appraised value(given loan-to-value ratio and loan amount) | -679s.png) |

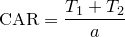

| 91 | Capital adequacy ratio |  |

| 92 | Equity Capital(given capital adequacy ratio and risk weighted assets) | -681s.png) |

| 93 | Risk weighted assets(given capital adequacy ratio and equity capital) | -682s.png) |

| 94 | Simple interest |  |

| 95 | Period interest rate(given simple interest,initial balance and time periods) | -684s.png) |

| 96 | Initial balance(given simple interest,period interest rate and time periods) | -685s.png) |

| 97 | Time periods(given simple interest,period interest rate and initial balance) | -686s.png) |

| 98 | Composition of interest rates |  |

| 99 | Real interest(given nominal interest,inflation and representative value) | -688s.png) |

| 100 | Inflation(given nominal interest,real interest and representative value) | -689s.png) |